Have you heard about NACH mandate? Ever since the evolution of payment systems in India, one such program that has gained popularity is NACH. The full form of NACH is the National Automated Clearing House. National Payment Corporation of India (NPCI) offers payment systems in India to banks, financial institutions, and Government.

The purpose of NACH is to make way for electronic inter-bank high and low volume debit or credit transactions that are periodic and repetitive in nature. NACH debit and NACH credit are the two types of NACH facilities that are available in India.

Read more: Formulas and Examples to Calculate Interest on Fixed Deposits

If you want to know more about NACH and concepts regarding it, then here is a post to help you out! Read on!

What are the two Types of NACH mandates?

1. NACH – Debit:

It is used for the payment collections such as mutual funds, telephone bills, SIPs, electricity bills and much more.

2. NACH – Credit:

This facility is provided to distribute interest, dividend and Salaries and others

In simple words, NACH is a confirmation that customers offer to institutions to debit or credit funds.

What are the benefits of NACH debit mandate to banks?

The advantages of NACH debit to the bank are as follows:

- Digitization and standardization of mandates letting entire audit trail of the mandate life cycle

- Simplification of mandate acceptance and process of recording

- It leads to lessened operational cost for banks and its customers

- Helps in reaching higher revenues for banks and clients – the scope of service expansions PAN India

- Same-day processing is now possible

- Direct access of NACH to corporates – helping to know transactions; status without delay

- Uploading work reduction to the sponsor banks as the file upload gets to be done by corporates

What is NACH mandate management system?

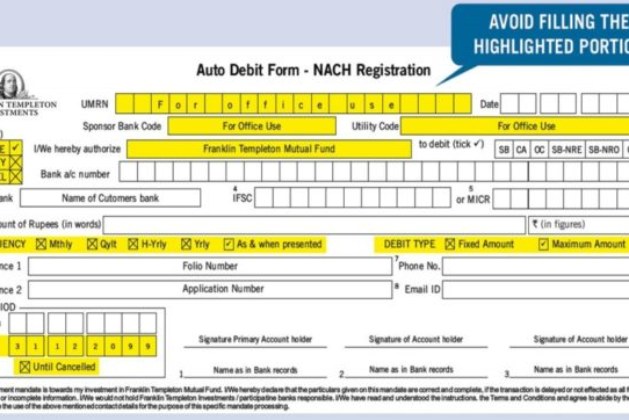

NACH mandate management system is a service of NACH debit that provides for the process of Mandate creation, mandate cancellation and mandate amendment. It also paves the way for all MIS concerning the mandate.

Mandate creation:

It lets you create a new mandate in favor of the user organization.

Learn more: What is a Small Cash Loan Facility and Why To Select It?

Mandate amendment:

The amendment of variables of an existing one that is active is possible. You need to quote UMRN for amendment.

Mandate cancellation:

It enables you in the cancellation of the mandate that is already active – you need to quote UMRN for the same.

What are the different Mandate creations?

You should know that there is a total of two creation of a NACH mandate, such as:

- UI based – a user is allowed to log into the National Payment Corporation of India (NPCI) given MMS utility and get started with a mandate with the help of a user interface.

- File based – you can also create a NACH mandate using files. The MMS utility also provides you with the facility to upload a mandate that’s more than one. It is facilitated via a file upload method. However, the file format that gets accepted is XML only.

Learn more: Check Provident Fund (PF) Balance In Just Five Minutes

What should be the size and format of the scanned mandate?

Here is the specification of the scanned mandate. Have a look:

- Front image

- The image needs to be in black and white

- The image should always be in TIFF format

You are now aware of many aspects concerning National Automated Clearing House (NACH). It is one of the accepted methods of payment available these days in India. It is reliable, fast and cost effective payment system to send and receive payments across India.

You can get started with NACH payment system without hassles and stay worry-free for the receiving and sending of money. You need to submit the PAN Card, Aadhaar Card, cancelled cheque, Duly signed ECS mandate to avail an EMI Network Card.

Leave a comment